wisconsin auto lease sales tax

The sales tax for car. Form RUT-50 Private Party Vehicle.

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

This page describes the taxability of leases and rentals in Wisconsin including motor.

. This page describes the taxability of. The Dealer and Agent Section DAS is now offering a voluntary dealer training seminar to interested dealer owners and their representatives. Driving excitement to a new level in a New Nissan Sedan.

While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Wisconsin auto lease sales tax Monday August 15 2022 Edit. What youll pay depends on the local regulations type of car and whether you buy or lease the vehicle.

Equipment Provided with an Operator. Add the tax payment to the lease payment. Ad Tech that changes every part of your drive with performance efficiency for the win.

You will have to pay insurance premiums. Wisconsin residents must pay a 5 percent sales tax on car purchases. If you end the lease early.

Therefore if a nonresident of Wisconsin enters into a one-payment lease and receives an automobile in Wisconsin AND the nonresident does not use the automobile in. For vehicles that are being rented or leased see see taxation of leases and rentals. This would be the lease payment before taxes.

Motor vehicles held for sale which are assigned to and used by persons holding an ownership interest in Wisconsin licensed motor vehicle dealerships who are not subject to withholding for. Driving excitement to a new level in a New Nissan Sedan. There are also county taxes of.

Ad Tech that changes every part of your drive with performance efficiency for the win. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Motor vehicles held for sale which are assigned to and used by persons holding an ownership interest in Wisconsin licensed motor vehicle dealerships who are not subject to.

Visit a Dealer Today. And sales tax on the monthly payments. An interesting twist on the taxability of rentals and leases can arise with equipment that is provided with an operator.

135 41667 55167. Visit a Dealer Today. Using the above example the math would read.

Form RUT-25-LSE Use Tax Return for Lease Transactions due no later than 30 days after the date the vehicle is brought into Illinois or the date of lease. What You Need to Know. Sales Taxes and Leasing.

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

Free Car Vehicle Receipt Template Pdf Word Eforms

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Montana Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver I Bills Things To Sell Template Printable

Alabama Firearm Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Wor Bill Of Sale Template Template Printable Bills

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

How To Gift A Car A Step By Step Guide To Making This Big Purchase

New Vehicle Sales Fall To 1999 Levels How To Grow Revenues After 20 Years Of Stagnation Yup You Guessed It Wolf Street

What S The Car Sales Tax In Each State Find The Best Car Price

Trade In Sales Tax Savings Calculator Find The Best Car Price

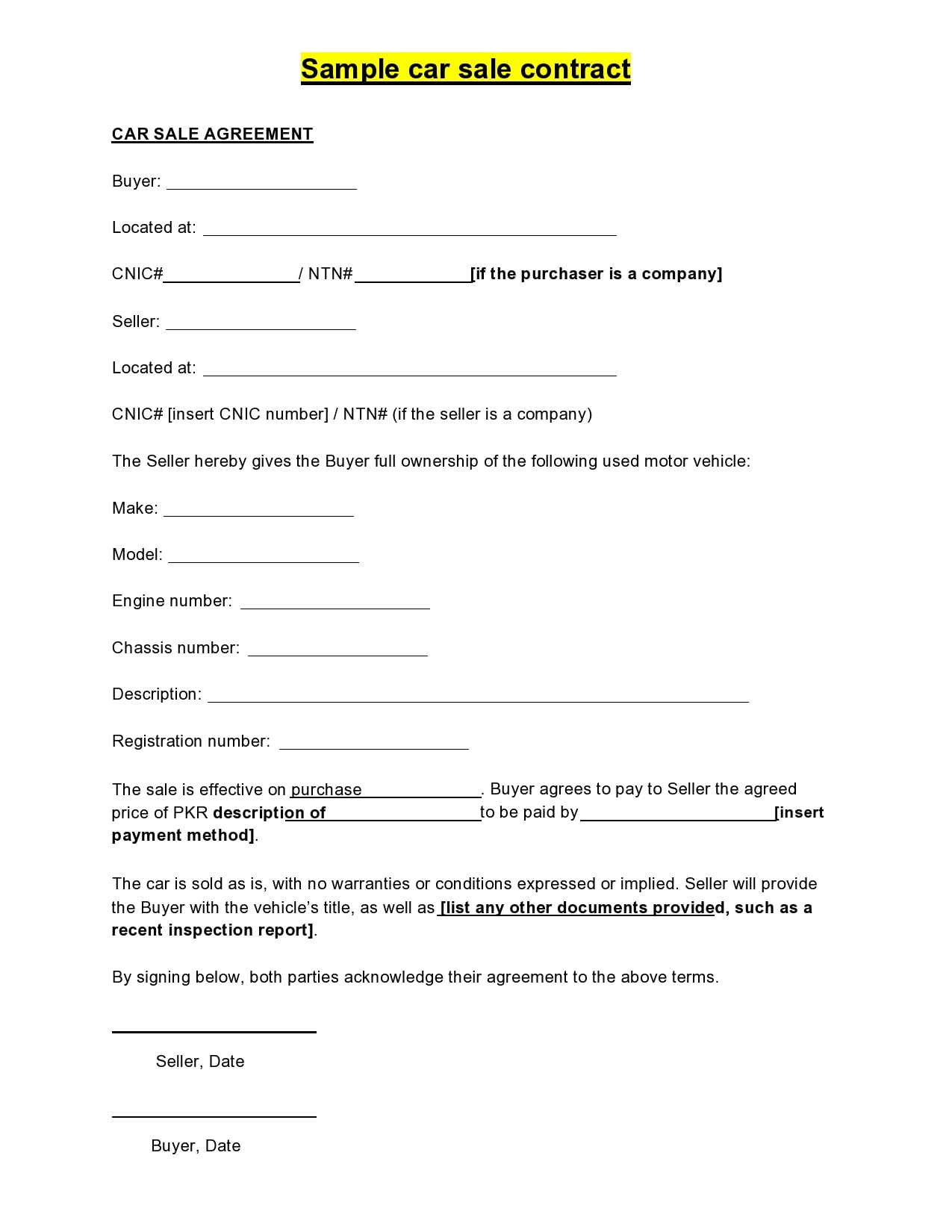

30 Simple Car Sale Contract Templates 100 Free

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

What S The Car Sales Tax In Each State Find The Best Car Price